Summary

- The UK has some of the highest industrial electricity prices in Europe, with prices 46% above the International Energy Agency member countries’ median.[1]

- High electricity prices are frequently cited as a barrier to growth – deterring investment in new manufacturing facilities and posing a major challenge to the ongoing viability of a wide range of businesses.

- In addition, businesses must transition from burning fossil fuels to reduce exposure to volatile international prices.

- Many businesses already use electricity e.g. for refrigeration and lighting, while a number have adopted air to air heat pumps to provide both heating and cooling.

- Despite the growing availability of electric technologies for many other applications, from space heating to manufacturing processes, high electricity costs relative to gas make electrification prohibitively expensive.

- Various policy costs and taxes are placed on energy bills, with almost all those paid by non-domestic customers placed on electricity, making electricity more expensive than gas. The situation has worsened, with the average electricity-to-gas price ratio rising to between 4:1 and 5:1 over recent years, up from just over 3:1 in 2012.

- The Climate Change Committee (CCC) advises in the seventh carbon budget that electrification is the main route to decarbonising industry, and tackling high electricity prices relative to gas is essential to enable this.[2]

- In 2024, Energy UK developed proposals for rebalancing policy costs for domestic customers by moving most environmental and social levies[3] onto gas, while moving some to government spending to mitigate distributional impacts.[4]

- Energy UK has continued this work to explore the options for non-domestic energy bill rebalancing. Implementing these proposals would reduce non-domestic electricity prices by around £40/MWh,[5] cutting electricity costs for GB businesses by up to 15%.

Recommendations

- Energy UK has modelled several scenarios to reduce the difference in non-domestic electricity and gas prices. The analysis assumes that industrial gas prices are not increased and that moving all non-domestic policy costs onto the bills of gas customers, especially those that are very energy-intensive and/or exposed to international markets, would be unattractive as some businesses may continue to rely on gas long-term.

- Achieving a shift in gas-to-electricity price ratios requires legacy policy costs and Climate Change Levy (CCL) payments to be removed from electricity bills as the grid decarbonises,[6] alongside increases in gas CCL rates for most sectors. The revenue from gas CCL is likely to fall over time as usage is reduced, however this should help cover the period where Renewable Obligation (RO) and Feed-in Tariff (FiT) costs are still high and wholesale electricity prices have not yet declined.

- This would leave £1 – 4 billion of annual revenue to be recovered by general taxation as well as hypothecated Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading Scheme (ETS) revenues. Hypothecated revenues could cover the shortfall, but only if carbon prices are high.

- It is vital that Government consults on options to rebalance non-domestic electricity and gas bills this year and allocates funding for it in the Spending Review to keep British businesses in the UK and achieve legally binding carbon budgets.

Contents

Impacts on end users and ratio of electricity to gas price

The problem

The UK has the highest industrial electricity costs in the G7, and some of the highest in the world, with prices 46% above the average cost in International Energy Agency (IEA) member states.[7] Not only do higher electricity prices translate to lower business productivity, but in a globalised economy they reduce investment, as firms look to countries where their costs will be lower.[8],[9] They also increase the cost of goods and services for consumers.

High electricity prices relative to gas also makes it difficult for organisations to move away from gas, even when it would be a more efficient use of energy. This leaves them exposed to volatile international gas prices and rising carbon prices. International companies looking to invest in new modern facilities may instead focus on countries where the economics of electrification are more attractive, leaving UK facilities behind.

Figure 1: industrial electricity prices in IEA member states, DESNZ (2025)

The make-up of electricity costs will change as the power system decarbonises, although major falls in electricity prices are unlikely in the near term unless there is a drop in global gas prices, which would also lower the cost of gas. This leaves changes to policy costs and/or taxation as the most immediate levers that can be used to reduce electricity costs across the economy and encourage investment in electrification. It is also an option that is within the Government’s control, unlike the price of gas which is traded internationally and based on a range of factors.

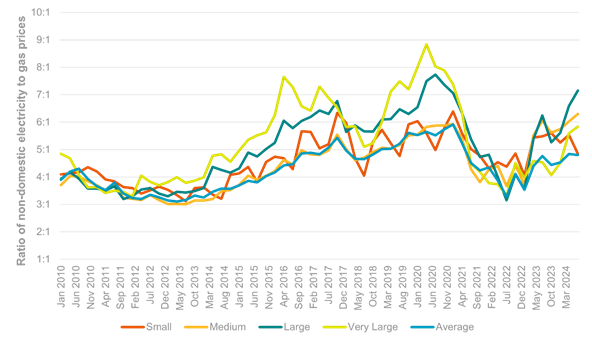

Almost all policy costs paid by non-domestic customers are placed on electricity, making electricity more expensive and electrification less viable. The situation has grown worse over time, with an average electricity-to-gas ratio for non-domestic customers between 4:1 and 5:1 over the past couple of years, up from just over 3:1 in 2012.

This report uses average prices across all non-domestic energy users. However, the relative prices of electricity and gas vary between firms. The largest users typically pay around half as much for each unit of gas as the smallest, but with much smaller savings on electricity. This means large energy users face much higher relative electricity costs, ranging from five to eight times for electricity compared to the price of gas in recent years, compared to the smallest users, which typically pay around four to five times.

Figure 2: Electricity to gas price ratios for different sizes of businesses

Source: DESNZ (2024), Quarterly Energy Prices[10]

In addition to higher running costs, many electrification projects will face a range of practical barriers such as getting an electricity network connection and some may require significant upfront capital expenditure (CapEx) to pay for the connection and changes to production processes at manufacturing sites. However, this analysis focuses on operating expenditure (OpEx) as it is a key barrier to all projects, regardless of CapEx requirements.

The analysis assumes that industrial gas prices are not increased and that moving all non-domestic policy costs onto the bills of gas customers, especially those that are very energy-intensive and/or exposed to international markets, would be unattractive as some businesses may continue to rely on gas long-term. This may be due to current technical limitations to the adoption of low-carbon alternatives or a lack of alternative fuel supply and infrastructure.

Case study 1: Food manufacturer trying to move away from Combined Heat and Power (CHP)

A significant decarbonisation journey is well underway at this multi-site manufacturing business where the production process has a very high demand for heat. It currently operates highly efficient natural gas fired Combined Heat & Power (CHP) plants at all its sites to supply this heat and also the power to meet onsite energy demand, with any surplus electricity exported to the electricity network. As a business it has committed to carbon reduction targets under the Science Based Target initiative (SBTi) and has made good progress in recent decades through significant investment in energy reduction and efficiency projects. The cost savings from reduced energy usage have meant that these projects have also delivered good financial returns.

The business has recently explored electrification, using renewable electricity, to support the total decarbonisation of the heat required in the production process. Electrification at any of its sites would require investment in electric boilers (to generate low pressure steam) and/or heat pumps, requiring significant changes to existing CHP plant operations, running into £10m’s of investment. It would also require a very significant upgrade in the electricity supply to the site. However, once this upfront investment had been made, rather than seeing a reduction in energy costs, the business would then face much higher energy operating costs as the cost per unit of electricity is significantly higher than for natural gas.

Typically, the business only proceeds with capital investments that have a maximum of a six-to-seven-year payback period. Although, in practice, the majority of successful projects have substantially shorter payback periods (i.e. higher returns on investment). However, whilst electrification would reduce greenhouse gas emissions and the company’s exposure to gas prices, it would have negative returns due to current energy pricing structures. This is due in part to the high levies on electricity. In addition, the need for a considerable upgrade in the electricity network connection is also a significant barrier.

The business has enquired about the potential for additional electricity import capacity at its sites but has been told by Distribution Network Operators that there is very limited or no additional capacity currently available.

Case study 2: Business case of a UK food manufacturer – Fuel switching from gas-fired heat to 100% electrification. This food manufacturer is growing rapidly and is committed to avoiding the use of fossil fuels. In support of its rapid growth trajectory, a new factory was quickly designed, built and commissioned. It utilises two gas-fired steam boilers to supply heat for hot cleaning water and steam for cooking. The main electrical loads are to run manufacturing process plant e.g. motor drives, lighting etc, but also a sizeable refrigeration plant that provides cooling and freezing for raw materials storage, process, and finished goods storage. Undertaking a review in 2023, the food manufacturer’s consultants, ADJ Consulting Ltd, identified opportunities to expand capacity in a more energy efficient way. Additionally, they were able to re-use heat recovered from the electrically powered refrigeration plant using a heat pump and mechanical vapour recovery (MVR) technology, which are also electrically powered. The recovered heat is then able to displace all the site gas used to raise hot water and steam.

The factory and its plant are under three years old, with a life estimated at around 20 years before replacement would be required. The financial appraisal of the project, therefore, rests entirely on the returns from full costs of investment rather than leaning on essential replacement of existing equipment as an additional driver. A project to improve existing steam cooker efficiency and deploy heat pumps and MVR to generate steam would increase electricity consumption from 12.3GWh a year to 26.8GWh a year and eliminate the current gas use of 64.7GWh entirely, cutting 13ktCO2e a year (equivalent to taking 9,000 typical petrol cars off the road). The site is paying around 20p/kWh for electricity and only 4p/kWh for gas, and the estimated Coefficient of Performance (CoP) of the heat recovery part (heat pump and MVR combined) would be 2.73. The overall capital cost of the project is estimated at £5.19 million and implementing the fuel switching scheme alongside other efficiency measures, including measures to reduce water consumption, would reduce operating costs by £657,000 per annum. The company wants to make the investment but, in spite of the CO2e reduction potential, there is no sensible financial case that supports the project. The high ‘spark gap’ between electricity and gas prices is the key sensitivity and drives a payback of around eight years.

The company is not cash constrained in making capital investments where the returns are sensible (versus other uses of its cash) and looks for paybacks of around four years for this type of sustainability project. For contrast, in a straight productivity investment, the normal payback hurdle would be two and a half years, or ideally less. To achieve a four-year payback would require the average electricity price to reduce from 19.9p/kWh to below 15p/kWh, or for the price of gas to climb from 4.1p/kWh to 5.5p/kWh.

The solution

Electricity costs would need to be around two to three times that of gas to justify electrifying space heating and some industrial processes. This assumes the same energy costs for those processes, given the average coefficient of performance[11] of an air-source heat pump ranges from 1.9-2.8 in UK trials.[12] However, some electrification processes would need a lower ratio to switch away from gas (see the Annex on the levelised cost of heat).

There are currently £5.7 billion of annual policy costs levied on electricity, which Energy UK recommends the Government remove from non-domestic electricity bills to enable this difference to be achieved.

Figure 3: Current non-domestic electricity bill policy costs

Electricity prices for non-domestic customers could be reduced by around 15% or £40/MWh by removing the following costs from electricity:

- Renewables Obligation (RO) and Feed-in Tariffs (FiT): legacy costs for previous renewable support schemes.[13],[14] This would help the majority of businesses which pay for all policy costs (legacy and current) to electrify, but not the most energy-intensive end users that are eligible for the Supercharger support package which already exempts them from RO and FiT.[15]

- CCL on electricity: acts as an additional carbon price that is no longer appropriate for an increasingly decarbonised power system.

Our analysis only considers current costs. The Government needs to consider which new policy costs including the Dispatchable Power Agreement (DPA), Nuclear Regulated Asset Base (RAB) and potentially a Carbon Capture Usage and Storage (CCUS) Levy will be added to the electricity bill. The picture is further complicated by the introduction of the hydrogen levy on gas bills (via an obligation on shippers) with a possible exemption for some industrial customers.

Reducing levies would also heighten wholesale price signals which are needed for efficient electricity system operation. This is vital given the scale of demand side response needed to both achieve Clean Power 2030 and minimise system costs, as recently set out by the National Infrastructure Commission’s report on the distribution network.[16]

There is an international precedent for policy cost rebalancing. In 2022, Germany removed renewable policy costs, firstly from industry to increase competitiveness then from all bills, in the face of high electricity bills resulting from gas price spikes.[17]

Electricity customers in Germany no longer pay the Erneuerbare-Energien-Gesetz (EEG) levy from July 2022. The EEG levy was introduced in 2000 and was known as the “green power surcharge”, to subsidise the expansion of solar, wind, biomass and hydropower plants. The Federal Government will instead use revenue from the special Energy and Climate Fund (EKF) to subsidise renewable energy projects. The EKF fund is partly self-financing as it invests in clean energy projects but also receives income from national emissions trading and CO₂ pricing.

The EU Clean Industrial Energy Deal and Affordable Energy Plan published in February 2025 suggests Member States remove levies and taxes from electricity as far as possible to enable electrification and includes proposals for a new Industrial Decarbonisation Bank that will provide capital support.[18]

Impacts on end users and ratio of electricity to gas price

Changes to electricity and gas prices will impact different end users differently, depending on their relative use of each form of energy. As can be seen in Table 1 below, gas consumption is significantly higher than electricity in the public sector, whereas the opposite is true in the commercial sector.

Table 1: Energy use per sector in the domestic sectors

We modelled a range of scenarios to explore options to remove these costs from electricity prices. We considered how costs could be spread across different users, the resulting impact on electricity-to-gas price ratios, and funding requirements.

In all scenarios, gas prices are kept the same for industrial users. This is because:

- The most energy-intensive users are already exempt from most policy costs and currently receive free allowances under the UK ETS (until CBAM is introduced). The interaction between a rebalancing policy and the ETS is likely to be complex.

- Industry is most exposed to high energy costs and is vulnerable to foreign competition. Intervention is needed to support British industry. Reducing electricity costs without increasing gas costs for the whole industrial sector is an effective way to deliver that support.

- Outside of industry, gas is used almost exclusively for providing low-grade heat for space and water heating, along with cooking. Industry uses gas as a feedstock for processes as well as to provide higher-temperature heat. This makes it harder for some industrial users to transition away from gas in the near term.

Government may however wish to consider scenarios where gas prices are raised for a limited sub-set of industrial users that are able to move away from gas and where some of the biggest electrification gains could be made.

We modelled three scenarios that deliver different levels of decarbonisation through policy cost rebalancing alone, with different funding requirements:

- Higher decarbonisation, higher business cost: Achieves the greatest reduction in electricity-to-gas price ratios to an average of 1.9:1, by moving the entire cost of RO, FiT and electricity CCL onto commercial and public gas users. There would be no direct cost to HM Treasury, but this would lead to much higher costs for public sector organisations and will see relatively high increases in overall commercial energy costs.

- Central: Achieves a balanced electricity-to-gas price ratio (2.2:1) by injecting £1.6 billion of public money per year to remove some policy costs from energy bills rather than moving them all to gas. This results in costs across the commercial sector remaining broadly flat but public sector energy costs rise by £1 billion.

- Cautious decarbonisation, lower business cost. Achieves the maximum viable electricity-to-gas price ratio for some decarbonisation (3:1) but sees substantially lower costs for commercial users and only marginally higher costs for public sector organisations. Requires high public spending (£4 billion per annum).

Table 2: Options to reduce ratio of electricity to gas prices

Energy UK believes the central scenario in Table 2 above represents the best option as it gives a ratio of electricity-to-gas of 2.2, enabling the adoption of efficient heat pumps, and does not result in higher commercial energy prices while avoiding the high end of Government funding.

Given the significant diversity in energy use across UK businesses and sectors, which use different proportions of gas and electricity, any rebalancing will always have losers as well as winners. Looking at some specific examples of how this policy might play out, Energy UK’s analysis finds that major UK retail food chains would immediately see their energy costs fall by between 9% and 15%. This could feasibly mean households paying less for their groceries. The impact on a typical drinks-only pub demonstrates the importance of approach taken. Depending on the option chosen, energy costs could increase by 7% or decrease by 5%. Another example used was a food manufacturer that is using considerably more gas than electricity. Under the three scenarios that we modelled, the business’s energy costs increased from approximately £6 million to almost £10 million under the different scenarios.

Table 3: Impacts of rebalancing scenarios on specific businesses

| Policy impact | Major UK retail food chains | Drinks-only pub | Food manufacturer |

| Higher decarbonisation, higher business cost | -9% | 7% | 60% |

| Central | -12% | 2% | 41% |

| Cautious decarbonisation | -15% | -5% | 13% |

How non-domestic policy costs rebalancing can be achieved

Our modelling assumes that CCL on electricity is reduced to zero and increases on the price of gas are achieved through immediate increases in the rate of CCL on gas. However, in practice there would likely be some tapering over time, with gas rates steadily increasing as electricity rates decrease, allowing end users to adjust.

Rebalancing gradually can enable a managed transition, where the most economically viable electrification projects go first. This will be important to spread out the number of new or reinforced network connections required as organisations electrify, and provide time to increase electricity network capacity.

Policy costs that relate to the core operation of the system e.g. Capacity Market (CM) and Contract for Differences (CfD) should continue to be levied on the vast majority of users of the electricity system to share costs fairly. However, future schemes to help commercialise nascent technology, e.g. Dispatchable Power Agreements for CCUS and Hydrogen to Power (H2P), should also be funded through hypothecated carbon taxes and general taxation and not placed on electricity bills.

Government should rebalance to level the playing field to enable cost-effective electrification to take place across the economy. Targeting support for electric heating only at those organisations electrifying operations would be challenging and less effective. This is because it will be difficult to differentiate between those electrifying versus those increasing production, and it would penalise early movers that invested in electrification before the date rebalancing was introduced. The effectiveness of targeting support might also depend on non-domestic customers’ application for support which could prove limited across SMEs where there may be a lack of knowledge of the benefits to them. However, it could potentially play a role as a bridging solution if broader rebalancing will take time.

We do not propose that Government seeks to achieve set ratios of gas/electricity costs directly through suppliers by increasing gas CCL rates or decreasing electricity policy costs and electricity CCL. Instead, the Government should remove RO and FIT costs (either through exemptions or rebate) and set the electricity CCL rate to zero. The cost of RO and FiT would then be funded by Government through revenue raised by an increasing gas CCL, general taxation and ETS/CBAM hypothecation.

Even with a reduction in the amount of policy costs on electricity, there is then likely to be a need for targeted electrification support to enable wider spread adoption of electrification technologies (see Annex). CapEx and OpEx support requirements will vary between sectors and types of companies.

Some smaller companies may struggle to find CapEx and find it hard to apply to the Industrial Energy Transformation Fund (IETF). Other larger companies, particularly those that are internationally owned, may need less support with CapEx, depending on the level of total funding available and competition between different countries for investment. The amount of OpEx support will also vary depending on the process involved e.g. those with access to waste heat that can be upgraded through a heat pump may need less support than others. [19]

Implementation considerations

Segmenting users into ‘industrial’, ‘commercial’ and ‘public sector’ will be challenging and may require new systems to be put in place. Exemptions or rebates could be applied to certain sectors with Standard Industrialisation Classification (SIC) codes, but some non-domestic customers may have to actively apply, or a new mechanism be created.

The mechanism would need to be designed carefully but could be similar to a mix of expanding the Supercharger to all non-domestic customers (but only for legacy policy costs), the Energy Bill Relief Scheme (EBRS) and the Energy Bills Discount Scheme (EBDS), as both were Government-funded not levy funded.

The RO scheme would continue to operate as it does currently to avoid additional complexity and new regulatory, revenue and cashflow risk for generators, suppliers and Power Purchase Agreement (PPA) offtakers or intermediaries.

New policy costs should be assessed and not automatically added to the electricity bill especially if they relate to innovative or early-stage technology deployment rather than inherent costs of running the system. These new policy mechanisms should then be categorised as capital investment to fit fiscal rules.

The change would need to be phased in carefully as some non-domestic contracts span a number of years; large shifts in cost allocation with a short lead time would create supplier gains and losses that can’t be passed through to or recovered from all customers.

How this can be funded

The different scenarios considered leave £1.7-4 billion of lost revenue or additional costs for the Treasury to cover. This could be funded through general taxation or hypothecated environmental taxes and levies.

Hypothecated taxes

The following are current and new taxes charged to encourage decarbonisation, so using part of the revenue to fund decarbonisation through lower electricity costs would be doubly effective:

- Carbon Border Adjustment Mechanism: uncertain range of revenue but forecasts of £200m-£1.8 billion.[20],[21] This would be a new source of income for Government that could be hypothecated to use for policy cost rebalancing when the UK CBAM is introduced in 2027.

- UK Emissions Trading Scheme: £5.8 billion in 2023,[22] but highly sensitive to carbon prices, it could fall to £1.6 billion by 2029/30.[23] However, carbon prices are likely to rise significantly due to the tightening of allowances by the 2030s and the future scope of the UK ETS is under review.[24] The Government also receives revenue from the Carbon Price Floor (CPF) that tops up the ETS price, raising an additional £587 million a year.[25] Additional UK ETS revenue resulting from higher prices and an expanded scheme could be used to partly fund policy cost rebalancing. Linking with the EU ETS could also help increase cumulative revenues by £8 billion between 2025 and 2030.[26]

- Climate Change Levy: Government could use the £337 million currently raised on gas CCL.[27] However, as existing revenue is already being used elsewhere, using this would leave an alternative funding gap and revenue would fall as gas use diminishes over time.

There might therefore be enough revenue from environmental taxes to fund rebalancing, although a higher carbon price (accompanied by an effective CBAM) is likely needed to realise that.

Public sector decarbonisation

The entirety of the cost in the higher decarbonisation, higher business cost scenario, and over one third of the costs in the central scenario come from the increased cost of energy by public bodies, which are disproportionately high users of gas. This figure can be reduced quickly over time through a programme of investment in public sector decarbonisation and energy efficiency. This could save on public funding in the long run, as well as improve the material condition of buildings, such as hospitals and schools (especially if paired with wider refurbishment). Investment in public sector decarbonisation would unambiguously be classified as capital spending and is therefore easier to increase in line with the Government’s fiscal rules.

Government currently provides funding for public buildings to install energy efficiency measures and low carbon heating systems including heat pumps. Phase 3 of the scheme will provide over £1.425 billion of grant funding between 2022 to 2026.[28]

Annex – Different costs of decarbonising heat

There is a range of both CapEx and OpEx for different low-carbon heat technologies that is specific to the technology, site, process and company size. Reducing the difference between electricity prices will accelerate the lower cost electrification options. for example, processes that can use waste heat and/or heat pumps. Further support will be needed to enable the conversion of less efficient or hard-to-convert processes where the technology is at earlier stages or more expensive. It will be important to start to electrify a wide range of applications across a range of industrial and commercial activities, to ensure barriers are tackled and any technology gaps identified. This will need to fit with the natural replacement cycle of new equipment to minimise costs and ensure sufficient progress is made.

A 2024 US study looked at opportunities to decarbonise lower temperature ‘indirect heat’[29] up to 200°C.[30] It found that industrial heat pumps are cost-competitive with natural gas boilers at some facilities, especially for industrial heat sources which require low-temperature heat where the heat pumps can be run at high-capacity factors, and in jurisdictions with low electricity prices. Without additional policy support, electric resistance boilers, renewable natural gas, and hydrogen are not cost-competitive with natural gas boilers (Figure 4). However, these technologies do not have the temperature limitations of heat pumps and are likely more appropriate for decarbonising higher-temperature heating requirements.

Figure 4: Levelised Cost of Heat of Modelled Technologies

Source: Center for Applied Environmental Law and Policy (2024) Decarbonizing Industrial Heat: Measuring Economic Potential and Policy Mechanisms

The study finds that policy support that reduces upfront investment costs (low-cost loans and investment tax credits) has limited potential to drive high heat pump adoption rates, since capital cost is a small portion of the overall levelised cost of heat. Conversely, policies targeting operating costs (carbon pricing and production tax credits), can drive much higher levels of adoption, depending on the values adopted, and have the potential to be much more transformative.

The electrification of higher temperatures is possible through a range of technologies and thermal storage. These processes tend to have higher CapEx and OpEx costs than lower temperature processes (e.g. highly efficient heat pump systems); however, this is not always the case, with notable exceptions in the glass and steel sectors. In some cases, electrification is the only option for extremely high-temperature processes e.g. carbon fibre manufacturing.

For more information about this paper, contact:

Rachel Cary, Head of Business Decarbonisation

rachel.cary@energy-uk.org.uk

[1] DESNZ (2025), International industrial energy prices

[2] Climate Change Committee (2025), The Seventh Carbon Budget Advice for the UK Government

[3] Renewables Obligation (RO), Feed in Tariff (FiT), Energy Company Obligation (ECO) and Warm Home Discount (WHD)

[4] Energy UK (2024), Policy solutions: Rebalancing bills in an affordable way

[5] This is equal to the current cost/MWh of the FiT and RO schemes + CCL electricity rate.

[6] The modelling for this paper assumes that CCL electricity rates are set to zero however in reality they would taper as CCL gas rates increase to enable a transition.

[7] DESNZ (2024), Industrial electricity prices in the IEA (QEP 5.3.1)

[8] Energy Strategy Reviews (2022), Energy crisis, firm profitability, and productivity: An emerging economy perspective

[9] Journal of Environmental Economics and Management (2024), The impact of energy prices on industrial investment location: Evidence from global firm level data

[10] To note: This chart does not include all categories. However, the average is over all categories

[11] Heat pump efficiency is measured by the Coefficient of Performance (CoP), which is the ratio of heat produced to electricity consumed. More heat energy is produced than electrical energy is consumed (CoP > 1), because heat is also extracted from the environment

[12] UK Parliament Post (2023), Heat pumps

[13] The Renewables Obligation (RO) scheme was designed to encourage generation of electricity from eligible renewable sources in the UK. The RO scheme came into effect in 2002 in Great Britain, followed by Northern Ireland in 2005. Source: Ofgem (2025) About the RO

[14] The Feed-in Tariffs (FIT) scheme was introduced in 2010 by government to promote the uptake of renewable and low-carbon electricity generation and requires participating licensed electricity suppliers to make payments on electricity generated and exported by accredited installations. Ofgem (2025), About the FIT scheme

[15] The Supercharger was introduced in April 2024 and fully exempts eligible firms from renewable energy policy costs including the small-scale Feed in Tariff, Contracts for Difference and the Renewables Obligation, as well as GB Capacity Market costs. There will also be a 60% reduction in network charges – the costs industrial users pay for their electricity supply. Eligibility for the Supercharger is determined by both a sector level test and a business level test. Businesses have to 1) be in electricity intensive sectors that are exposed to the pressures of international trade (and are thus deemed to be less able to pass on costs to their customers) 2) have electricity costs that amount to 20% or more of their Gross Value Added (GVA) metric to go on to receive support

[16] National Infrastructure Commission (2025), Electricity distribution networks: Creating capacity for the future

[17] German Federal Government (2022), Relief for electricity consumers

[18] EU Commission (2025), Affordable Energy and Clean Industrial Deal

[19] Energy UK (2025), Review of policies to drive commercial and industrial decarbonisation

[20] Frontier Economics (2024), The Carbon Border Adjustment Mechanism – its impact on UK competitiveness and carbon pricing

[21] Office for Budget Responsibility (2024), Economic and fiscal outlook – March 2024

[22] Office for National Statistics (2024), UK environmental taxes: 2023

[23] Office for Budget Responsibility (2024), Economic and fiscal outlook – October 2024

[24] DESNZ (2024), Traded carbon values used for modelling purposes, 2024

[25] HM Revenue & Customs (2024), Environmental Taxes Bulletin Tables (June 2024)

[26] Frontier Economics (2024), Linking UK and EU carbon markets

[27] HM Revenue & Customs (2024), Environmental Taxes Bulletin Tables (June 2024)

[28] DESNZ (2025), Public Sector Decarbonisation Scheme

[29] Heat generated primarily by boilers and combined heat and-power (CHP) equipment and delivered through intermediate fluids like steam generally at temperatures

[30] Since heat pumps are less efficient at high temperatures and few manufacturers focus on this application, the study applies a practical upper bound of 200°C to the delivery temperature at which heat pumps are most likely to be widely deployed over the next decade. The analysis estimates that 80% of manufacturing indirect heat is below 200°C.