9 January 2024

For more than 10 years, the Contracts for Difference (CfD) mechanism has spearheaded successive governments’ efforts to deliver secure, low-carbon power across Great Britain. Six allocation rounds (AR) have been completed between 2014 and 2024, helping to deliver investment in 39GW of renewable electricity across a range of technologies from wind to solar, tidal to biomass and more.[1]

This compares to just over 71 GW of de-rated generation capacity in 2024, demonstrating just how crucial a role CfD projects have to play in the coming years to meet the UK’s electricity needs.[2] Read more about how the CfD mechanism works in Energy UK Explains: Allocation Round 7 and Contracts for Difference.

As of November 2025, the scheme has 10GW of projects in operation – enough to power 15 million homes.[3] Over its 10-year life, it has enabled investment of approximately £85 billion into the UK economy, adding around 0.25% to GDP each year, according to Energy UK analysis.

Sophie Lethier, Interim Deputy Director of Policy at Energy UK, said: “The CfD scheme has successfully incentivised billions of pounds of inward investment in the UK and has been a major factor in renewables supplying an ever-growing share of the country’s electricity. It remains the best way to ensure renewable capacity is secured at the most competitive price, which is why it has been replicated across the world.”

While CfD costs are currently added to energy bills, the increase in renewables on the system has reduced the amount of time that gas power stations set the price of electricity. This is already lowering the wholesale price of electricity, with analysis from the Energy & Climate Intelligence Unit finding that wind power had brought it down by up to 25% in 2024.[4]

In addition to driving down the cost of technologies such as offshore wind, CfD-backed projects have delivered local investment, job creation and skills development across the country.

World-leading projects from Energy UK members such as Equinor, RWE, ScottishPower and SSE have brought clear and tangible benefits to the UK economy, both in regions and nationally, while pushing the UK towards greater energy security.

Billions invested across the country

AR1, which took place over 2014/15, kickstarted the UK’s path to global leadership in offshore wind deployment, with capacity rising from 4.5GW in 2014 to 16GW by the end of 2025. The technology has made up the lion’s share of capacity under the CfD scheme with almost 25GW procured so far.[5]

Among the successful projects in the first auction was the £2.5 billion East Anglia ONE (EA1) from ScottishPower Renewables. The 714MW project, located 43km off the coast of Suffolk, produces enough power for 630,000 British homes and is the first of four projects that will together add up to around 3.9GW.[6]

As part of the development of EA1, ScottishPower Renewables co-invested £5 million in Peel Ports Great Yarmouth to prepare it for construction and marshalling activity. This early investment has helped establish the port as a key resource for offshore wind developers, creating a valuable asset for decades to come.

Since then, ScottishPower Renewables has co-invested a further £10 million in the Port of East Anglia to support the construction of its £4 billion East Anglia TWO (EA2) offshore wind farm, which was successful in AR6. This will have a capacity of up to 960MW using turbine blades built in Hull by Siemens Gamesa under a £1 billion supply deal – helping to support its 6,000 UK employees.

As the years have progressed, the scale of these CfD-backed offshore wind projects has grown, bringing ever higher levels of investment.

Dogger Bank, for example, is expected to become the largest offshore wind farm in the world when all three phases are completed in the North Sea, more than 130km from the Yorkshire Coast. The 3.6GW capacity will provide enough power for six million homes annually for an expected 35 years.

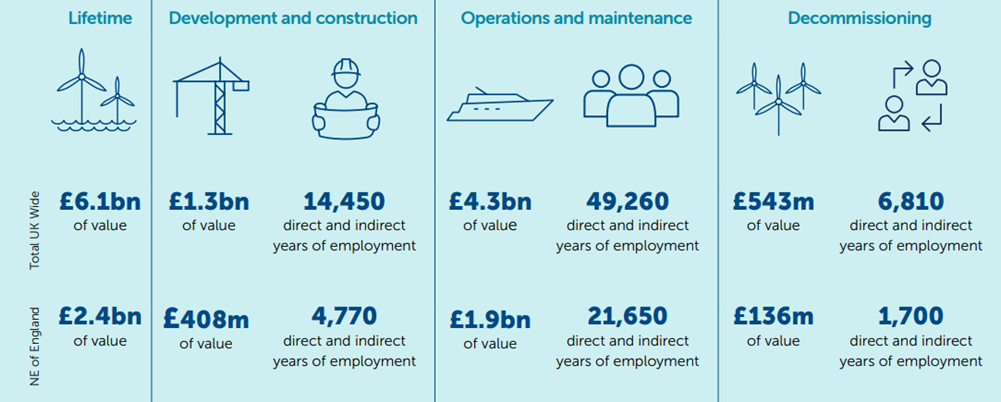

The total UK spend over the lifetime of the project, which is led by SSE Renewables, Equinor and Vårgrønn, is estimated to be around £8.4 billion, with much of this in the North East.

Its location requires onshore infrastructure near Redcar in the Tees Valley and South Shields in South Tyneside, as well as in East Riding of Yorkshire. The project partners have revealed that £3 billion is expected to be spent directly with companies in these regions. What’s more, an independent report from BVG Associates highlighting the significant economic impact of Dogger Bank Wind Farm over its lifetime estimates the project will single-handedly deliver a £6.1 billion boost to the UK economy as a whole. [7]

RWE commissioned a similar report from Wavehill Social and Economic Research into its 1.4GW Sofia offshore wind project. It found that over half of the £6.08 billion allocated to the project will be spent on the development and construction phases of the project, which together will generate around £760 million for the wider UK economy.[8]

With the offshore project making landfall near Marske-by-the-Sea and Redcar in Tees Valley, much of this economic benefit will also be felt in the North of England. Up to £181 million of this value will be created in the Yorkshire and Humber regions, with an additional £62 million in the North East.

While the scale of offshore wind farms delivers sizeable investment and economic growth, other projects supported under the CfD mechanism have also sparked investment right across the country.

ScottishPower Renewables is progressing several contracts awarded in AR4 to onshore wind projects totalling more than 324MW of capacity. The largest of these, the 119.7MW Cumberhead West project, is currently being built and is estimated to require approximately £152 million of investment during development and construction.

ScottishPower Renewables also expects to spend around £3.3 million on operations and maintenance (O&M) during each year of the project’s operational life. This could generate up to £42.6 million of value to the Scottish economy, including £13.3 million in South Lanarkshire alone.[9]

Investment brings jobs

These investments amount to billions of pounds across the country, which on the ground means jobs and skills opportunities in an emerging and exciting sector.

Estimates show that Dogger Bank, still in construction, supported 3,600 full-time equivalent (FTE) jobs in 2025 alone, with an average of 1,400 FTE jobs expected over the project’s operational life.

Figure 1: Dogger Bank offshore wind farm key statistics. Graphic provided by Equinor, SSE, and Vårgrønn.

RWE and ScottishPower’s offshore projects also account for significant job creation. Construction of the Sofia project will support 2,000 jobs, with an additional 80 long-term operations jobs, while building EA1 and EA3 is thought to support almost 6,000 jobs across the supply chain during construction. These two projects will also require 100 O&M jobs each, delivering long-term roles in the local area and often based in new facilities.

In July 2025, RWE opened a state-of-the-art O&M facility in Grimsby to provide constant monitoring and support to its UK offshore windfarms. Initially, the Hub will directly support almost 100 high-quality local jobs, growing up to 140 by 2027, as well as a local network of contractors and service providers.

Equinor, meanwhile, has established a base for O&M at the Port of Tyne in Newcastle, creating 400 long-term roles to support the wind farm. Vessel crew, turbine technicians and other O&M personnel will all be based at the facility, which was built with a focus on local construction, with 70% of Equinor’s hires local to the area.

These large projects have also created opportunities for thousands of apprentices, who take the first steps in their career learning skills while helping to deliver nationally significant infrastructure for a secure and clean energy system.

Equinor, for example, has committed to having two apprentices per year during the O&M phase of Dogger Bank – 70 apprentices in total. The supply chain supporting the project is also investing in our future workforce; civil engineering contractor Jones Bros ran an apprenticeship programme on site that included eight higher-level engineering apprenticeships, with six retained by the company.

In addition, six cadets from North Star, an Aberdeen-headquartered company that operates the largest cadet programme in the UK supporting careers in seafaring, marine engineering and as deck officers, were also able to gain experience aboard Dogger Bank service operation vessels (SOVs).

Over the past three years, North Star has invested £270 million and placed 160 experienced seafarers to support its Dogger Bank tonnage. It plans to recruit a further 160 seafarers for its expanding SOV fleet in the next three years to meet current contract charter commitments.[10]

Preparing for the future

Beyond the jobs and skills opportunities brought to local communities by CfD projects, developers are also helping to develop the future workforce through education and scholarship initiatives.

ScottishPower Renewables has placed East Anglia at the centre of its skills strategy to build up education around its four-project hub. During development of EA1, the project engaged with more than 3,000 pupils at all levels, including sponsorship of ten engineering Master’s degrees at the University of East Anglia and development of its first-ever apprenticeship programme.

Meanwhile, the £1 million community fund established for the construction phase of Dogger Bank has supported 36,000 young people via more than 200 schools, alongside university scholarships for anyone studying an undergraduate STEM degree and living in South Tyneside, Redcar and Cleveland or East Riding of Yorkshire. Over 120 of these £5,000 scholarships had been awarded as of 2025, with more to be launched in April 2026.

The project’s £25 million operational fund will continue this work, right down to promoting STEM subjects in primary schools. The project developers believe ensuring young people have access to this education before they get to secondary school is vital, reflecting the growing importance of STEM education across the economy.

Initiatives such as the award-winning Little Inventors programme, alongside South Tyneside Council, which uses creative design challenges to engage children and young people with STEM, aims to break down barriers in accessing STEM to ensure as many students as possible can study technical subjects if they wish.[11]

This strategy is carried all the way up to employment opportunities through the Building Our Futures initiative.[12] Now in its fourth year, the scheme aims to spark curiosity and raise career aspirations in children at a young age by connecting their classroom learning to the real-world jobs available in their communities. More than 60 employers have been involved to date, with 90% of local primary schools participating. The Dogger Bank project partners estimate 10,000 young people have been supported since the programme launched.

Such initiatives are not limited to students, with RWE aiming to ensure teachers are also fully trained to raise awareness of career opportunities in offshore wind. Champions for Wind, which ran from 2020 to 2025, helped to equip teachers in the Tees Valley area with training and resources to enhance lesson content around STEM and other related subjects.

An independent evaluation of the scheme found statistically significant gains in knowledge by students taught by ‘Teacher Champions’ across all key themes.[13] This included how offshore wind farms are built and operated, with students also demonstrating increased interest in learning more about careers in the sector. Crucially, according to RWE, it found that all pupils, regardless of gender, benefitted from the teacher training.

Energy in Action

The billions of pounds of investment brought about by CfD projects provide a wide range of benefits not just across local and national supply chains but also for communities, the existing workforce and young people across the country.

These case studies represent just a snapshot of the activity linked to CfD-backed projects. Around 39GW of renewable capacity has already been procured through the scheme. As with the projects listed here, each development requires community engagement and investment, bringing a huge range of benefits to the British economy.

With AR7 already underway, this combination of investment, jobs and skills development is set to grow even more. The AR7 budget is likely to unlock between £20 billion and £27 billion of private investment in offshore wind alone, with other technologies set to bring even more benefits.

Energy UK will continue to track and showcase the best that the CfD scheme has to offer. If you have any case studies demonstrating the benefits that CfD projects bring to local economies and communities, please get in touch by emailing press@energy-uk.org.uk.

[1] Low Carbon Contracts Company (2025) Contracts for Difference in a nutshell

[2] Department of Energy Security and Net Zero (2025) Digest of UK Energy Statistics (DUKES): electricity

[3] Low Carbon Contracts Company (Nov 2025) LCCC celebrates 10 GW of low carbon electricity powering British homes

[4] Energy & Climate Intelligence Unit (Oct 2025) Analysis: Growth in British renewables cutting electricity prices by up to a quarter

[5] House of Commons Library (Oct 2024) Contracts for Difference Research Briefing

[6] Iberdrola (Aug 2020) Iberdrola’s largest wind farm comes into operation: East Anglia ONE, in UK waters

[7] BVG Associates (Oct 2025) Economic impact of Dogger Bank Wind Farm

[8] RWE (Oct 2024) Sofia Offshore Wind Farm creating economic value for UK businesses and communities

[9] ScottishPower Renewables (accessed Dec 2025) Cumberhead West Windfarm

[10] North Star (January 2025) North Star celebrates full delivery of Dogger Bank SOV fleet, with naming of Grampian Tweed at Lowestoft Eastern Energy Facility

[11] South Tyneside Council (accessed Dec 2025) In partnership with South Tyneside Council and Dogger Bank Wind Farm, welcome to Climate Action Heroes

[12] Dogger Bank (Aug 2025) Building Our Futures Programme: Over ten thousand young people supported

[13] Sofia Wind Farm | RWE (Oct 2025) Independent evaluation confirms Champions for Wind programme boosts student knowledge and interest

‘Energy Matters’ is a proposal for partnership to unlock investment, transform the economy and deliver change.