February 2026

Key points

- Each year, the Government holds an auction in which renewable developers submit competitive bids to secure a Contract for Difference (CfD) to support their project. These auctions are known as allocation rounds.

- The results of the seventh allocation round (AR7) for non-offshore wind projects were announced on 10 February 2026. The auction procured 6.2GW of onshore wind, solar, and tidal. These projects will deliver £5bn of private sector investment, supporting 10,000 direct and indirect jobs.

- This builds on the success of the results of the offshore wind auction, announced in January 2026, which saw 8.4GW of capacity awarded contracts.

- In total, with across all successful technologies, AR7 procured a record 201 projects with 14.7GW of capacity – which the Government says is enough to supply power to 16 million homes.

- The CfD scheme is the main way the UK secures homegrown clean power and strengthens its future energy security.

- Having a CfD means renewable energy generators are guaranteed a set price for electricity, and households and businesses are protected from volatile global prices, often set by the price of gas.

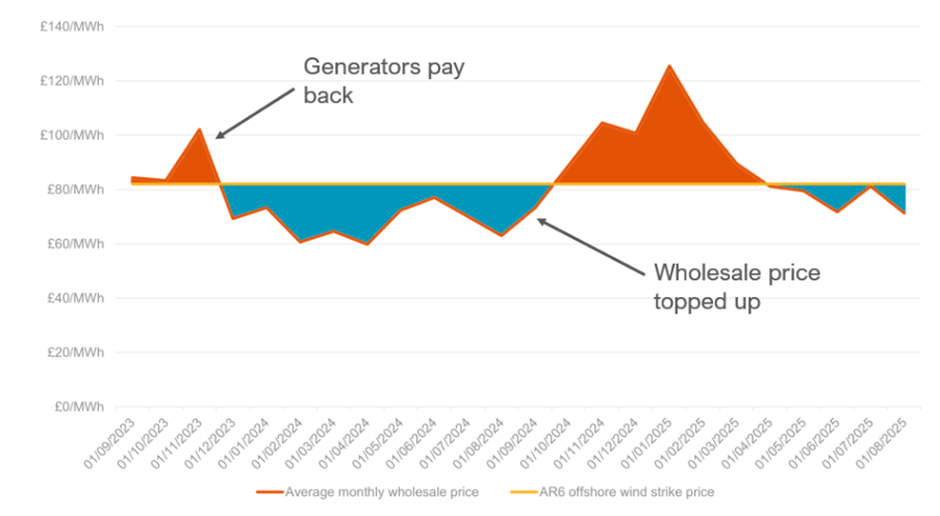

- The CfD is a win-win mechanism; if wholesale electricity prices rise above the agreed CfD price, generators pay back the difference to customers, and vice versa. This was evident in the recent gas prices crisis when CfD generators helped to shield billpayers from the full brunt of record high electricity prices.

- The fixed price gives developers the certainty they need to invest billions of pounds in the UK for projects with long construction timelines and high upfront costs. It would otherwise be difficult to commit that much investment based on such an unpredictable wholesale market. The CfD agrees a fair price for customers and ensures that developers make neither big losses nor excess profits once projects start generating electricity.

What were the AR7 results?

- The AR7 auction opened in 2025, with results for offshore wind announced in January 2026 and onshore technologies – solar, onshore wind, and tidal stream – announced in February 2026.

- AR7 delivered a record 6.2GW across the onshore technologies – 4.9GW of solar, 1.3GW of onshore wind, and 21MW of tidal stream.[1] This builds on the 8.4GW of offshore wind procured in January.

- The strike price for solar was £65/MWh (in 2024 prices). This is 6.5% lower than the previous strike price from AR6.[2] The strike price for onshore wind was £72/MWh, a 2% increase compared to AR6. It is worth putting this in context; the average wholesale price for the UK for 2025 was upwards of £80/MWh, and the cost for new build gas stations to operate is estimated to be around £147/MWh. [3]

Why are the results important?

- The projects which secured contracts in AR7 will deliver critical national infrastructure that will shore up the UK’s energy security and resilience and deliver stable energy bills for customers.

- Across all technologies, AR7 will deliver enough capacity to power up to 16 million homes, unlocking £27 billion of private sector investment in the UK, and providing energy security for decades to come.[4]

- AR7 will support up to 17,000 skilled jobs right across the UK, including in Scotland and Wales.

What are Contracts for Difference?

- The Contracts for Difference (CfD) scheme is the main way the UK secures its own sources of clean electricity. It was first introduced in 2014 as a way to make investment in clean energy less risky to attract private sector funding, and to help bring down the cost of renewable energy projects, like offshore wind.

- A CfD is a contract between a low-carbon electricity generator, like a wind or solar farm owner, and an arms-length body, called the Low Carbon Contracts Company (LCCC).

- Developers of new clean energy projects bid in a competitive auction to receive a contract which guarantees a price for the electricity they generate, offering stable and predictable revenue streams.

What is a ‘strike price’ and what is a wholesale price?

- During each competitive auction, developers bid to build their project for a guaranteed price of electricity for the length of the contract. This guaranteed price is called the ‘strike price’.

- This is different to the wholesale price, which is the price of buying electricity on the open market, often set by the price of gas. The wholesale price could be more than the strike price, but it could also be lower.

- The wholesale price fluctuates every day depending on several factors, including geopolitical risk, supply, and demand.

Why are developers given a ‘strike price’?

- Knowing in advance the price at which developers can sell their electricity for up to 20 years provides them with long-term revenue certainty. This removes some of the investment risk and helps to lower financing costs, project costs and ultimately lowers costs for households and businesses. As renewable projects have high upfront costs, but relatively low operating costs, financing costs have a significant impact on the overall cost of the project.

- There is now over 10GW of renewable electricity contracted by the CfD that is currently operational, with over 40GW in the pipeline.[5] In the 12 months up to October 2025, CfD projects generated enough to power 13 million homes – just under half the total number of houses in the UK.[6]

- CfDs are one of the main reasons for the UK’s world-leading renewables sector which has been replicated around the world. It is estimated that the amount of wind power on the system has already reduced the wholesale price of electricity by up to a quarter. [7]

How does a CfD auction work?

- The scheme works through an auction process, where developers compete with one another by bidding for a CfD. This auction process is called an allocation round. Seven allocation rounds have taken place to date, with the results of Allocation Round 7 (AR7) published in February 2026.

- During an allocation round, developers that wish to build renewable energy projects submit competitive and closed bids indicating the ‘strike price’ they need for their project. The Low Carbon Contracts Company (LCCC) awards contracts to bidders with the lowest strike prices until the whole budget for that allocation round is used up.

- Competition helps to ensure that renewable projects are procured at the best value possible.

What happens during the contract?

- For the duration of the contract, when the market price for electricity falls below the strike price, the LCCC will pay the generator the difference between the market price and strike price. If the market price goes above the strike price, the generator will pay the additional money back, as shown by Figure 1, which is a figurative example of what might happen.

Figure 1: Figurative example of how the CfD mechanism would have performed over the past two years with the offshore wind strike price of AR6 contracts[8]

- This means that the eventual cost to billpayers will depend on the market price. At the moment, CfDs add around £30 to an average annual bill.[9]

- The price of gas often sets the wholesale price of electricity, and during periods of high gas prices as seen in 2021 and 2022, CfDs provided net savings on our bills.

How are contracts awarded and what is the CfD budget?

- The allocation round ‘budget’ is not real money that the Government will spend. Instead, the term ‘budget’ refers to a theoretical calculation which is the projected difference needed to ‘top up’ generator payments between the agreed price of electricity and if the market price drops. Income for generators is paid via LCCC, the money for which is paid by customers through their energy bills.

- In reality, the market price fluctuates and can go above the strike price, in which cases generators end up paying money back to LCCC, as Figure 1 above shows. Essentially, the budget is a cap on how many projects can receive a CfD. It is not a fixed cost.

What happens next?

- The next auction round, AR8, will begin later in 2026. It will be important to maintain momentum and ambition in the offshore wind sector. AR7 faced significant delays, which created challenges and brought additional costs for developers and the wider supply chain. The focus for the next allocation round should be on returning to a timely auction schedule. A steady cadence helps to maintain confidence in the sector and its supply chain, which supports thousands of jobs across the UK.

For more information on this paper, please email press@energy-uk.org.uk.

[1] DESNZ (2026), Contracts for Difference (CfD) Allocation Round 7a: results

[2] DESNZ (2026), Contracts for Difference (CfD) Allocation Round 7a: results

[3] DESNZ (2026), Electricity generation costs 2025

[4] DESNZ (2026), New auction delivers unprecedented clean, homegrown power

[5] LCCC (2025), Contracts for Difference; Energy UK analysis

[6] LCCC (2025), CfD Historical Data; Energy UK analysis

[7] ECIU (2025), Growth in British Renewables Cutting Electricity Prices

[8] Ofgem (2025), Wholesale market indicators; DESNZ (2024), Contracts for Difference (CfD) Allocation Round 6: results; Bank of England (2025), Inflation Calculator; Energy UK analysis

[9] Ofgem (2025), Wholesale cost allowance methodology (Annex 2); Energy UK analysis